[[{“value”:”

Thank you for reading this post, don't forget to follow and signup for notifications!

If you’re looking into buying a suppressor—or any other firearm regulated under the National Firearms Act (NFA)—you’ll quickly come across the term “ATF tax stamp.” It might sound confusing at first, but the process is more straightforward than it seems once you understand the history, purpose, and steps involved.

This guide covers what an ATF tax stamp is, why you need one, how to get it, and what you should know about suppressor wait times—which are now shorter than ever.

What is an ATF tax stamp?

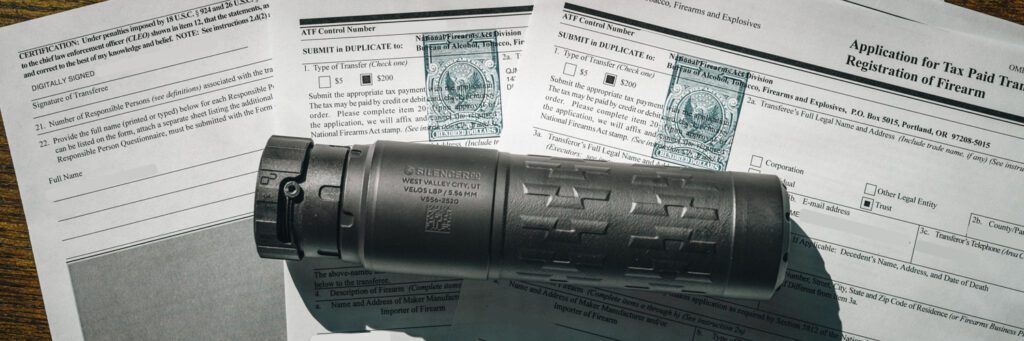

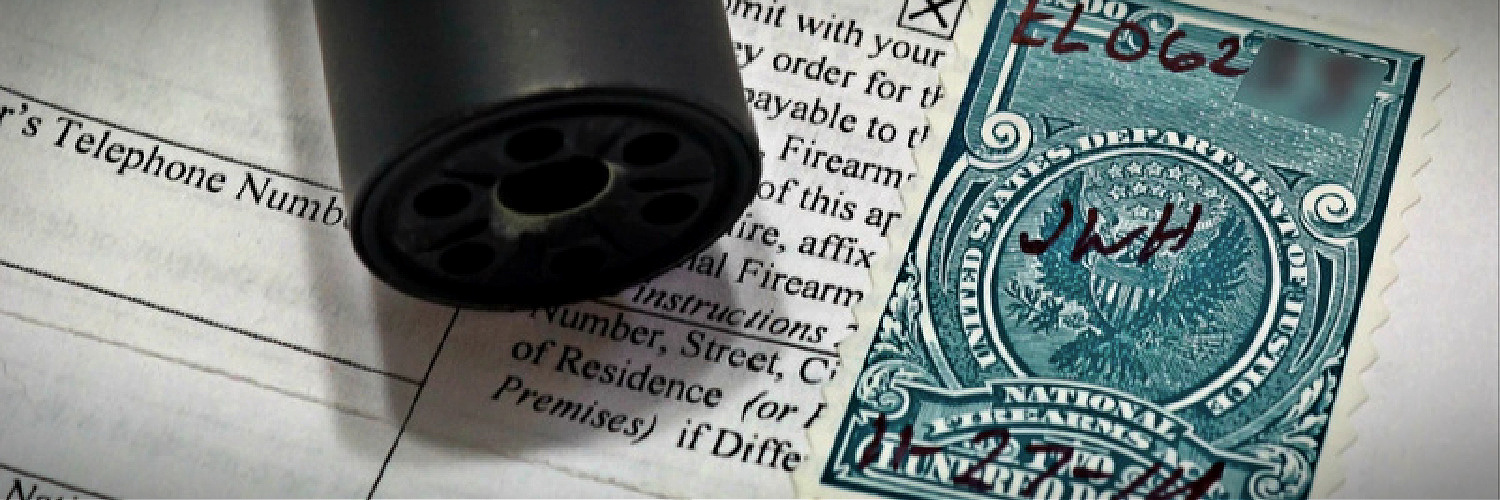

An ATF tax stamp is a postage-style stamp issued by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). It serves as proof that the required tax was paid and that the firearm is legally registered under the National Firearms Act (NFA) of 1934.

NFA-regulated items include:

- Suppressors (silencers)

- Short-barreled rifles (SBRs)

- Short-barreled shotguns (SBSs)

- Fully automatic firearms

- Certain specialty firearms classified as “Any Other Weapon” (AOW), such as pen guns or cane guns

When the NFA passed in 1934, lawmakers set the tax stamp fee at $200—roughly the cost of a new car at the time—in an attempt to discourage ownership. That fee remained unchanged for more than 90 years, even as firearm prices soared.

A historic change is here. Starting January 1, 2026, the ATF tax stamp fee drops from $200 to $0. The application paperwork and approval process are still required, but for the first time since the NFA was created, the cost barrier is gone.

Key point: Each NFA item requires its own stamp. Two suppressors? Two stamps. A suppressor and an SBR? That’s two stamps. They are not transferable between items. The difference now is that, after 2026, those stamps no longer cost you anything.

Why Do You Need an ATF Tax Stamp?

The tax stamp isn’t optional—it’s the legal mechanism that allows you to own and possess an NFA firearm or accessory.

Completing the paperwork registers the item in your name, giving you lawful possession. Without it, owning these items is illegal.

But beyond legality, NFA-regulated items—especially suppressors—provide clear benefits:

- Hearing protection: Reduces gunfire noise to safer levels.

- Improved accuracy: Less muzzle blast helps you stay on target.

- Reduced recoil: Makes firearms easier to control.

- Practical use: Useful for hunting, range training, and home defense.

All tax stamp revenue goes directly to the U.S. Department of the Treasury. For example, in fiscal year 2024, the ATF collected more than $145 million in NFA-related taxes.

How Much Does a Tax Stamp Cost?

The fee has been $200 per NFA item since 1934. Once a prohibitive cost, it became just another step in the buying process—until now. As of January 1, 2026, that fee drops to $0, while the paperwork and approval requirements remain.

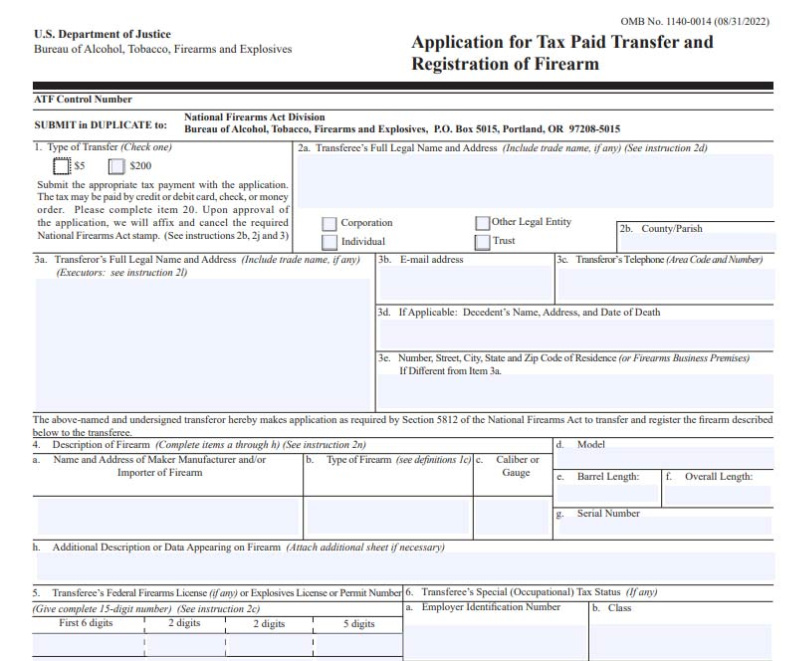

What is the ATF Form 4?

The ATF Form 4 Individual is the official paperwork required to apply for and receive a suppressor. It’s similar to the Form 4473 used when purchasing a firearm, but there are a few additional steps. Here’s what you’ll need to provide:

- Passport-style photograph

- FBI Form FD-258 fingerprint card

- Physical description

- Full legal name, place of residence, and phone number

Many dealers will assist with the process, and some even have kiosks in-store to help streamline things.

For a more detailed look at how to buy a suppressor, check out our Step-by-Step Guide.

How Long Does It Take for Your Form 4 to Get Approved?

Historically, suppressor wait times were one of the biggest frustrations—often stretching six months or longer. But things are looking very different now.

Suppressor Wait Times in 2025:

- eForm 4 submissions: Approvals are coming back in just days for many buyers.

- Paper Form 4 submissions: Still slow—can take several months.

In fact, it’s now common for people filing electronically to have their suppressor approved within a week. That’s a massive improvement compared to the year-long waits some shooters faced in the past.

The ATF has confirmed these faster timelines are expected to continue, thanks to upgraded systems and streamlined workflows. If you’ve been putting off buying a suppressor because of the wait, now is the best time yet.

You can stay updated on current wait times by checking the ATF’s form wait times here.

How To Get a Suppressor Tax Stamp

Here’s a step-by-step look at the process of getting a suppressor tax stamp:

Choose a Suppressor

Select the suppressor that fits your needs, considering factors like caliber, size, and intended use. Research different models and make sure they’re compatible with your firearms.Decide on Filing Type

Choose whether to file as an individual, trust, or corporation. Each option has distinct implications for ownership and transfer of the suppressor.Individual: The most straightforward option, where you’re the sole owner.

Trust: A legal entity that allows multiple people (like family members) to legally possess the suppressor.

Corporation: Ideal for business use, where the suppressor is owned by the business rather than an individual.

Submit ATF Form 4

Complete ATF Form 4 with accurate details about yourself and the suppressor. Accuracy is key to avoid delays. You can submit the form on paper or electronically (eForm).

Historically, each Form 4 required a $200 tax stamp. As of January 1, 2026, the cost is reduced to $0, though the paperwork and approval process still apply. After 2026, the stamp is essentially free.

Wait for Approval

After submission, the ATF will review your application. Once approved, you’ll receive your suppressor tax stamp, and the suppressor will be legally yours.

Suppressor Tax Stamp FAQs

When it comes to suppressor tax stamps, you may have some common questions about the rules and requirements. Here are answers to some frequently asked questions:

Do I have to carry my tax stamp with me?

Not the original. But keep a copy—digital or paper—in your range bag or rifle case. If an ATF agent asks, you must show proof.

Can I transfer a tax stamp to another item?

No. Each item requires its own stamp. If you sell or transfer an NFA firearm, the new owner must file their own Form 4.

Can someone else use my suppressor?

Yes, but only if you’re present. For independent use, set up a gun trust and add them as a trustee

Do I need to notify the ATF if I move?

- Suppressors: No notification required.

- SBRs and some other NFA firearms: You must file ATF Form 5320.20 before transport.

Does the ATF come to my house while I wait?

No. The ATF doesn’t inspect private homes during the wait. Your Fourth Amendment rights remain intact.

Note: This is for informational purposes only and should not be construed as legal advice.

Yes, It’s Worth It!

The ATF tax stamp is the legal gateway to some of the most useful and enjoyable firearms accessories available today. While the process involves paperwork and some patience, current wait times are shorter than ever—especially if you file electronically.

Whether for hearing protection, accuracy, or overall shooting comfort, a suppressor is one of the smartest firearm upgrades you can make. And thanks to the eForm system, you might have yours in hand in less than a week.

“}]]